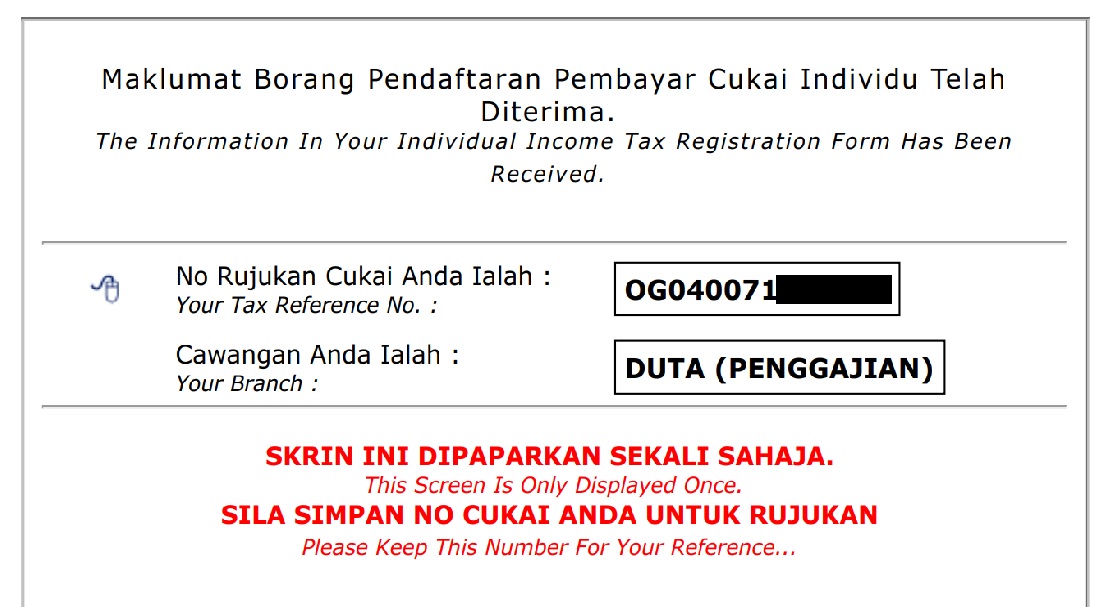

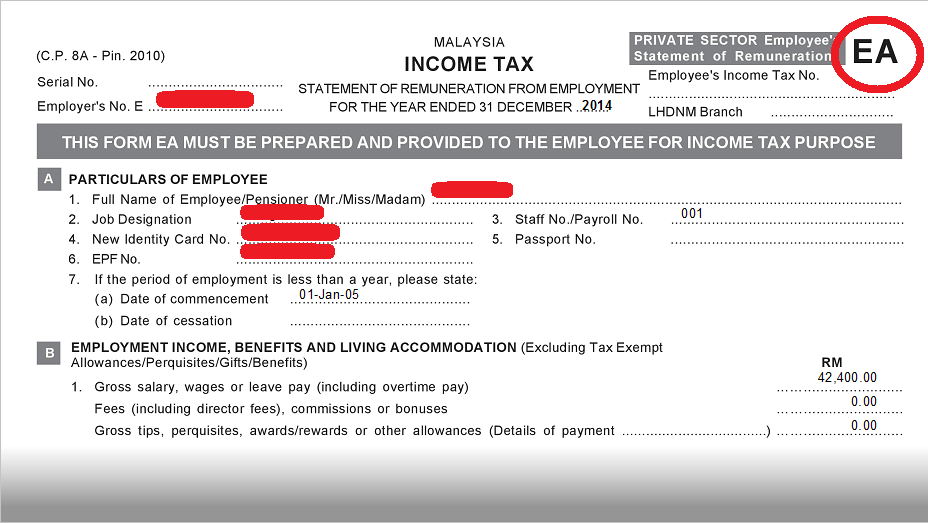

Contoh Income Tax Number Malaysia

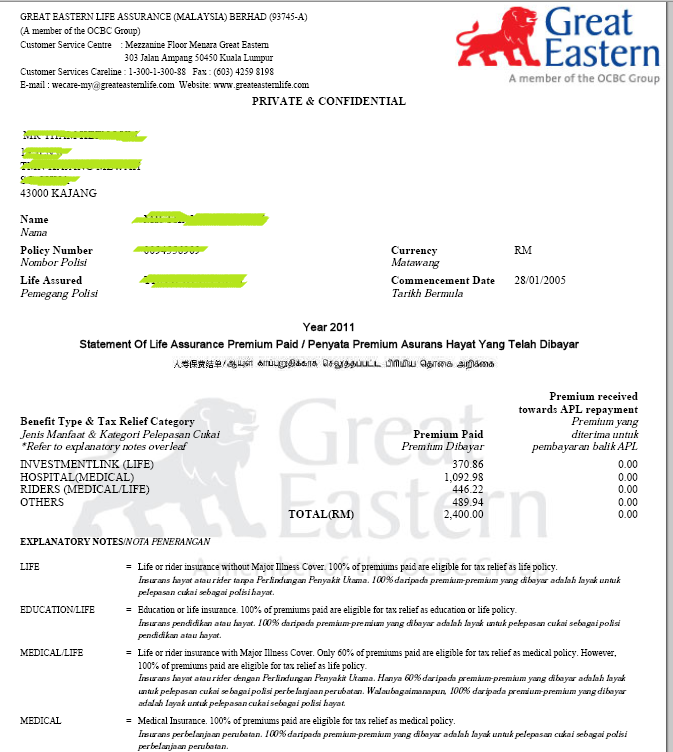

Income tax and vat.

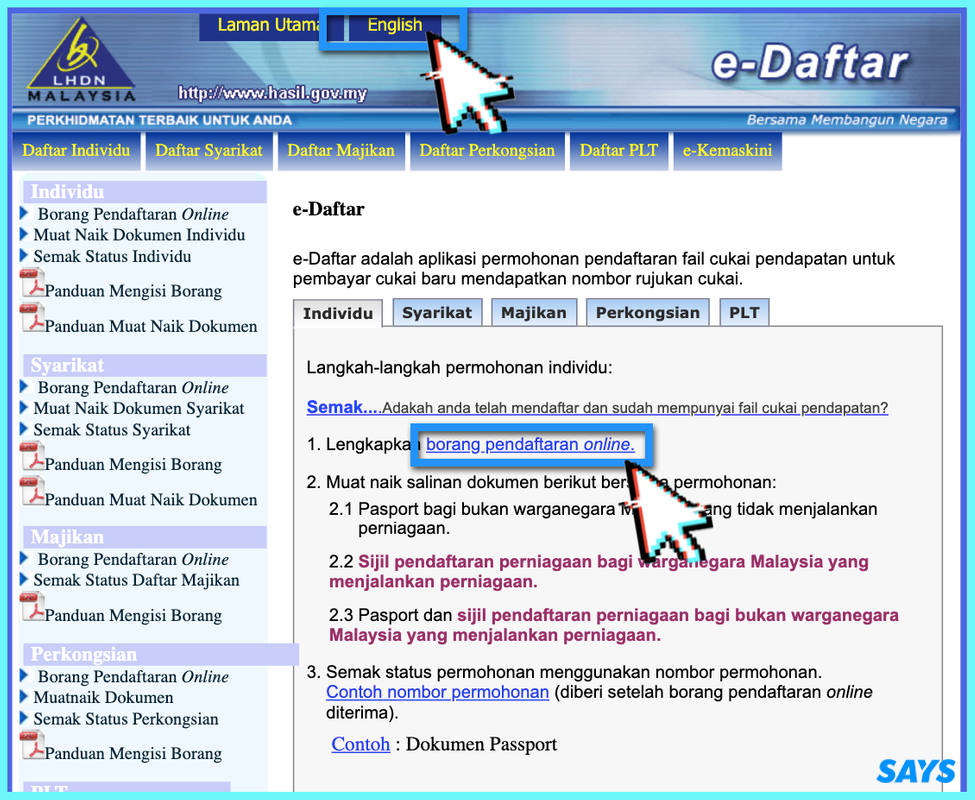

Contoh income tax number malaysia. Npwp is a set of number given to taxpayer both individual and entity for personal identification in carrying out their taxation rights and obligations i e. Form n for appeal under petroleum income tax 1967 4. Please quote your application number problems complaints comments. Lembaga hasil dalam negeri malaysia classifies each tax number by tax type.

If the application for extension of time is allowed the irbm will issue form cp15a pin 1 2009 informing the appellant the extended date for submission of form q which is thirty 30 days from the date of cp15a. It is also commonly known in malay as nombor rujukan cukai pendapatan or no. Iv pos malaysia berhad counter and pos online write down the name address telephone number income tax number year of assessment payment code 084 and instalment no. Contact 03 8913 3800.

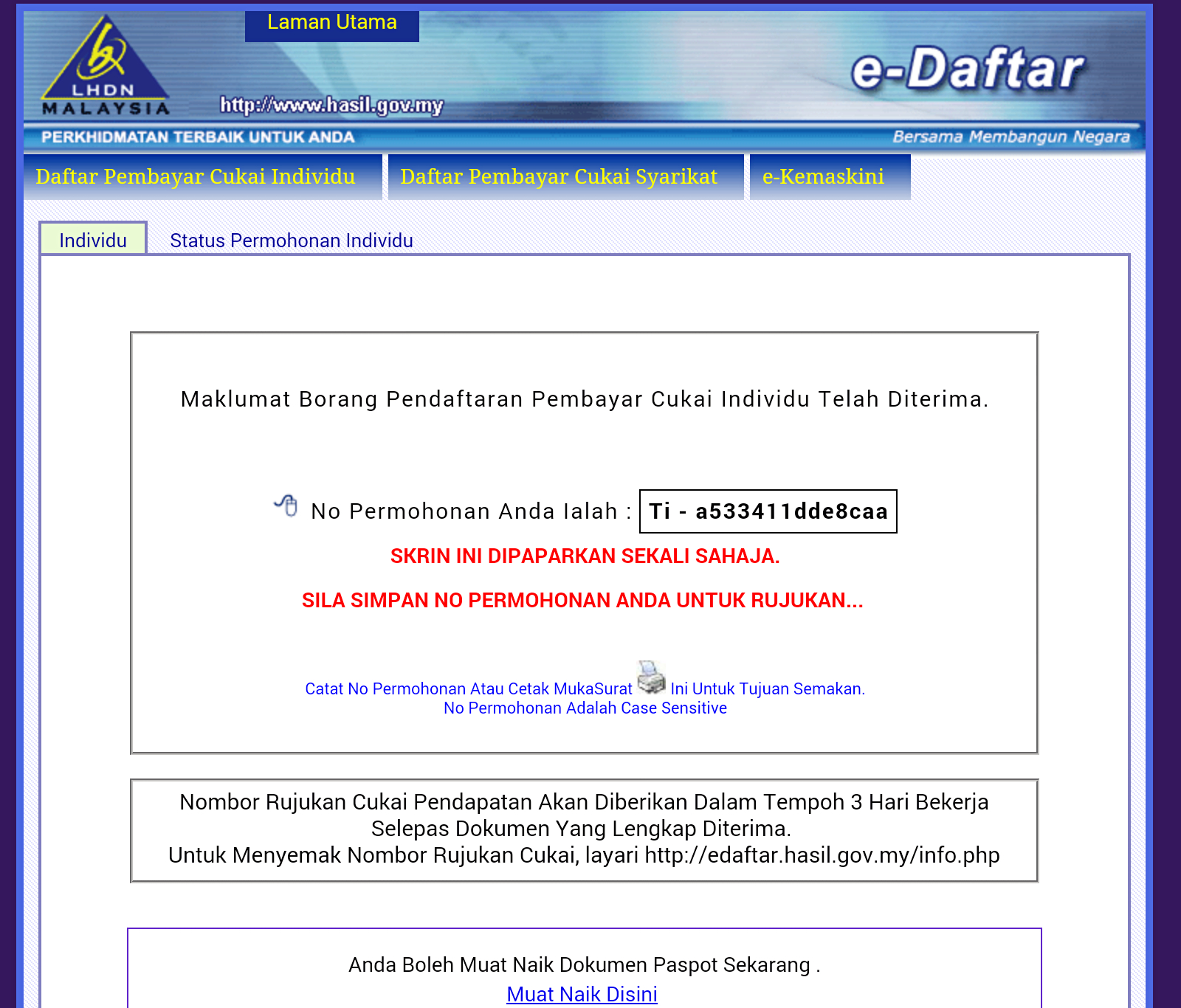

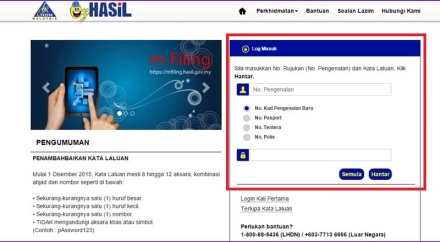

The inland revenue board of malaysia irbm assigns a unique number to persons registered with the board. Semakan nombor cukai pendapatan individu lembaga hasil dalam negeri malaysia. Please used the given application number to check your application status. Malaysia has no wht on dividends in addition to tax on the profits out of which the dividends are declared.

Tax identification number tin is known in indonesia as nomor pokok wajib pajak npwp with details as follows. An income tax number or tax reference number is an unique identifying number used for tax purposes in malaysia. 99 on the reverse side of the financial instrument. Berikut adalah beberapa contoh bagi perbelanjaan yang dibenarkan dan perbelanjaan yang tidak dibenarkan.

This number is issued to persons who are required to report their income for assessment to the director general of inland revenue. The most common tax reference types are sg og d and c. The documents required for this application are. Check the receipt s bank payment slip s before leaving the payment counter.

Restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Some treaties provide for a maximum wht on dividends should malaysia impose such a wht in the future. Interest on loans given to or guaranteed by the malaysian government is exempt from tax. Within 3 working days after completing an online application.

This unique number is known as nombor cukai pendapatan or income tax number. Syarikat yang mendapat msc malaysia status company layak untuk memohon elaun cukai pelaburan. Each corporate taxpayer is also required to appoint one individual that will be given the authority to keep and be in charge of the organisation s digital certificate. Authorised individuals under subsection 75 1 a of the income tax act 1967.

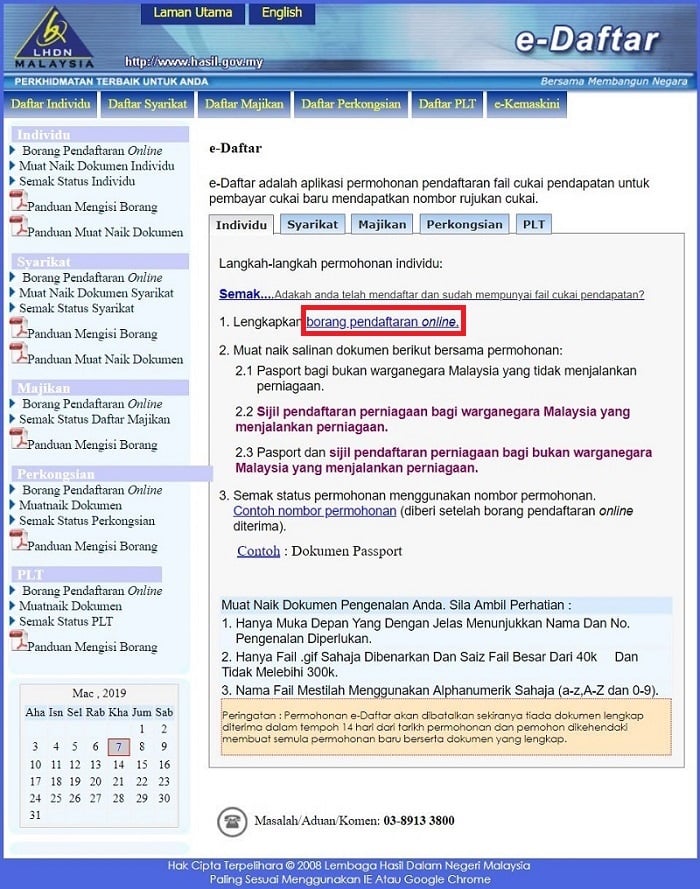

The inland revenue board of malaysia malay. Check your application status. Click link to e daftar.