How To Register Lhdn For Personal

Understanding tax rates and chargeable income.

How to register lhdn for personal. An e register application will be cancelled if complete documents is not received within 14 days from the date of application and an applicant must make a new application together with complete document. Apply for pin number. According to lhdn foreigners employed in malaysia must give notice of their chargeability to the non resident branch or nearest lhdn branch within 2 months of their arrival in malaysia. If your email address registered with lhdn browse to ezhasil e filing website and click pin number application.

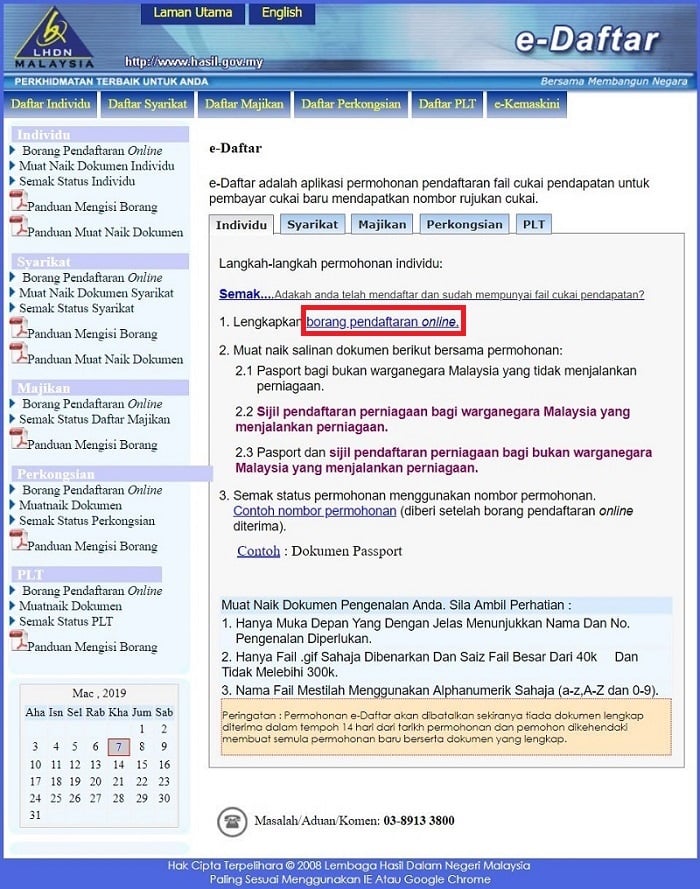

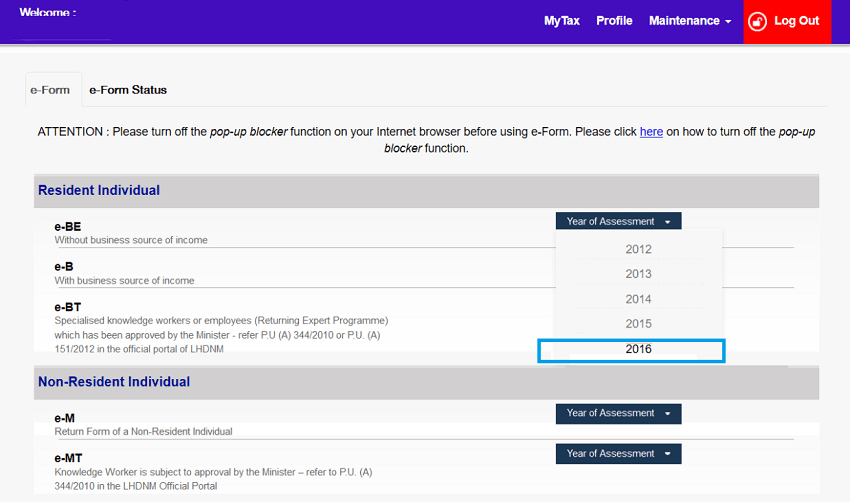

Here are the income tax rates for personal income tax in malaysia for ya 2019. The application must be attached. Application to register can also be made through online via e daftar. Also lhdn extended the dateline for extra 2 weeks.

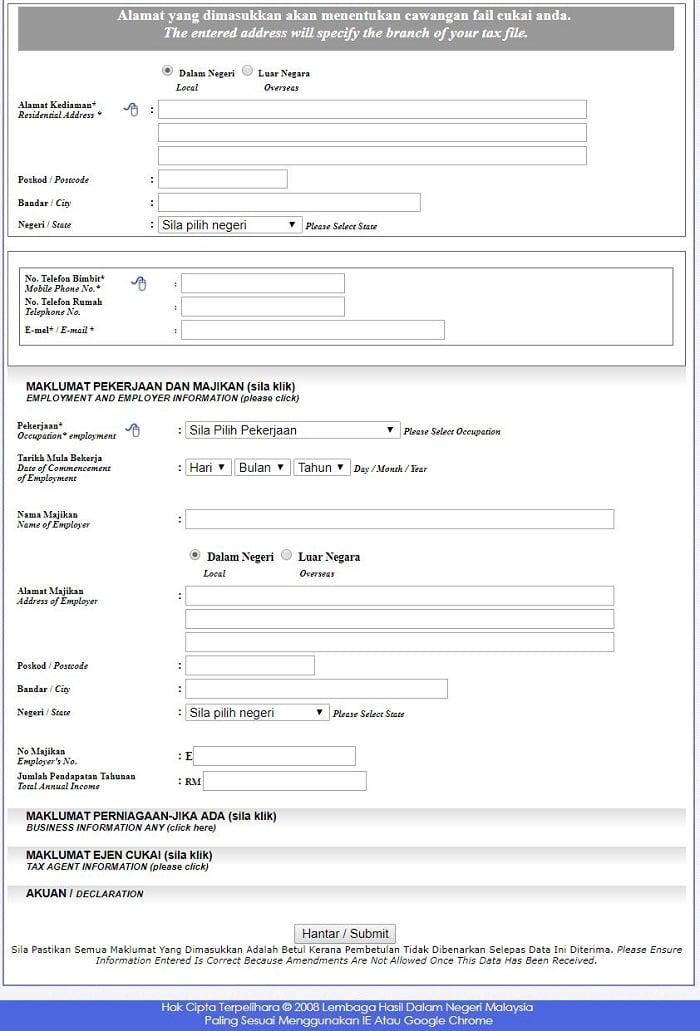

If you email address not registered with lhdn you have to fill up online feedback form to obtain pin number. Through mail or. Pengenalan identification no. Nama pengarah name of director.

Latest salary statement ea ec form or pay slip. Register at the nearest irbm inland revenue board of malaysia lhdn lembaga hasil dalam negeri branch or register online at hasil gov my. How to register tax file application to register an income tax reference number can be made at the nearest branch to your correspondence address or at any irbm branch of your convenience without reference to your correspondence address. Pendaftaran kwsp majikan employer s epf registration no.

The most important thing is you will get a faster refund in case you paid excess income tax through pcb. Kad pengenalan baru tentera polis pasport. For a new taxpayer or existing taxpayer who would like to complete itrf for the first time there are a few steps you have to complete prior to filling the itrf form online through e filing. Complete and submit the registration form.

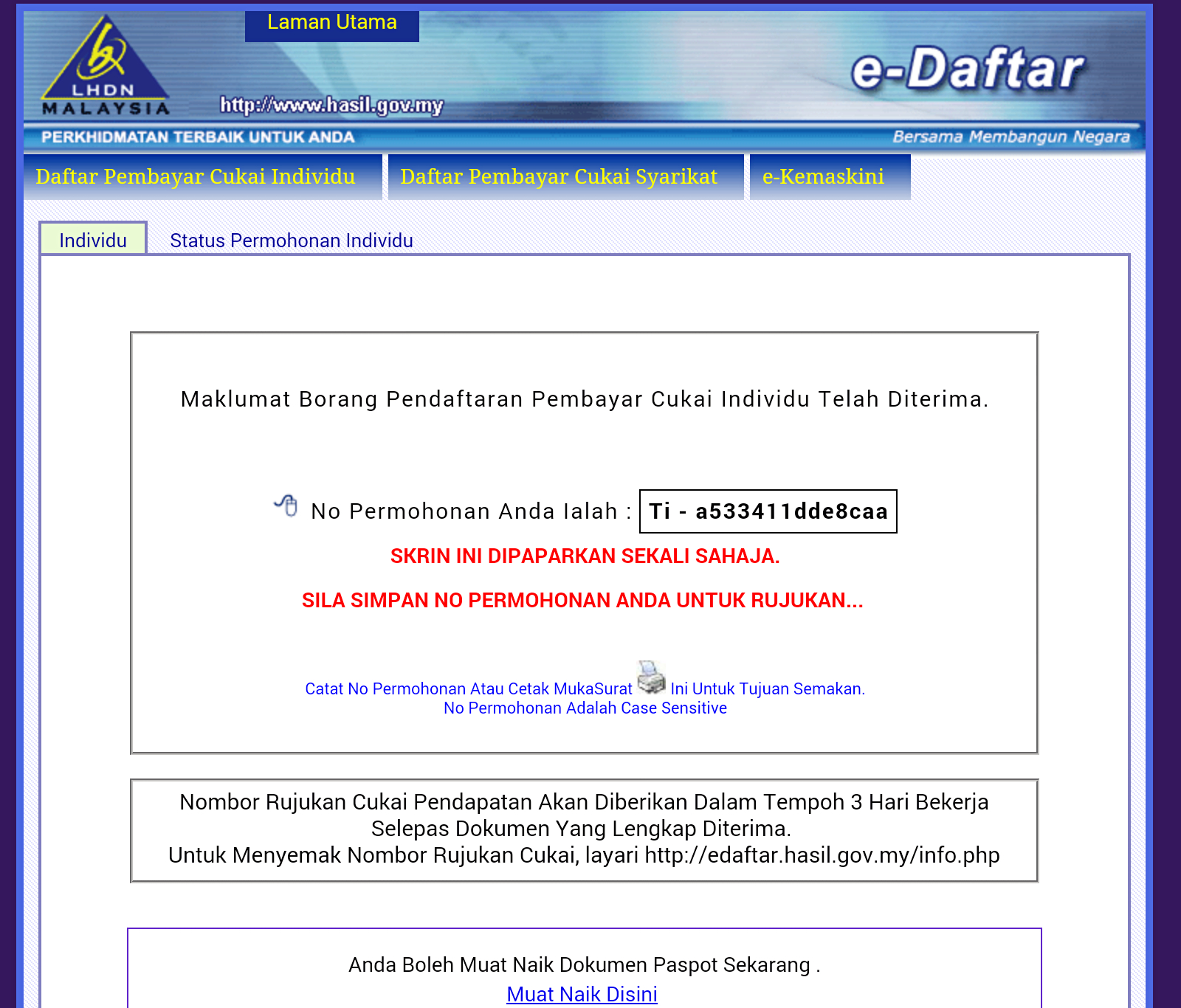

An application or registration number will be assigned to you upon successful submission. Provide copies of the following documents. If you are newly taxable you must register an income tax reference number. Notice of registration of company under section 15 companies act 2016 or certificate of incorporation of company under section 17 companies act 2016 if available notification of change in the register of directors managers and secretaries under section 58 companies act 2016.