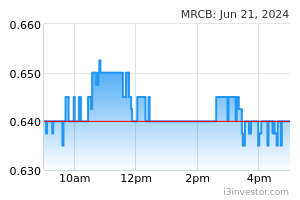

Malaysian Resources Corporation Berhad Share Price

Mohd imran bin tan sri mohamad salim has been managing director of malaysian resources corporation berhad since july 2 2018 and as its executive director since march 1 2015.

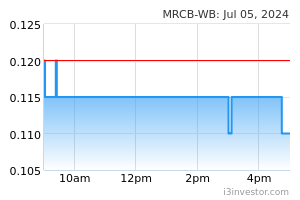

Malaysian resources corporation berhad share price. The company is organized into three business segments. With a price to earnings or p e ratio of 70 1x malaysian resources corporation berhad may be sending very bearish signals at the moment given that almost half of all companies in malaysia have p e ratios under 16x and even p e s lower than 9x are not unusual however the p e might be quite high for a reason and it requires further investigation to determine if it s justified. Malaysian resources corporation berhad 1651 kl kuala lumpur kuala lumpur delayed price. Stock analysis for malaysian resources corp bhd mrc bursa malays including stock price stock chart company news key statistics fundamentals and company profile.

Year on year malaysian resources corporation bhd s revenues fell 29 47 from 1 87bn to 1 32bn. Malaysian resources corp bhd mainly operates in property and infrastructure development in malaysia. Amsteel corporation berhad is a malaysia based investment holding company. 0 4850 0 0000 0 00 as of 11 19am myt.

The company retains complete control over its own property development. View live malaysian resources corporation berhad chart to track its stock s price action. Klse mrcb price estimation relative to market march 28th 2020. Malaysian resources corp bhd description.

Malaysian resources corporation berhad s p e of 73 31 indicates some degree of optimism towards the stock. The property segment is engaged in property development and management and operation of hotels. Latest share price and events. Mrcb is a leading urban property developer with a large portfolio of successful integrated commercial and residential developments anchored around transportation hubs.

The focus of its property development and investment division is a mixed portfolio of transport oriented commercial and residential developments. You can see in the image below that the average p e 9 5 for companies in the construction industry is a lot lower than malaysian resources corporation berhad s p e. The plantation segment is engaged in cultivation of oil palm and rubber.